Growing economic pressures are fuelling demand for UK-based independent consultants, stoking already strong growth across the top end of management consulting’s gig economy.

According to a new study by Odgers Connect – an arm of executive search firm Odgers Berndtson that helps organisations source independent consultancy support – the market for independent consultants in the UK is heating. The firm polled over 400 freelancers active in the field of strategy, management and digital consulting, asking them to assess the importance of external factors in their work for clients, both overall and in relation to current economic pressures.

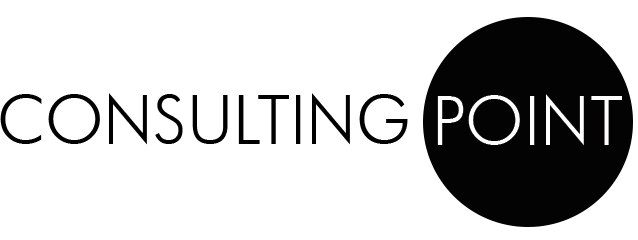

The findings show that external pressures feature prominently in organisations’ decisions to hire an independent consultant (88%), with the challenges posed by Brexit, economic slowdown, the need to find new markets and digital transformation cited by over 80% as important, increasingly or extremely important. Digital transformation is, in the wake of the rapidly evolving technology landscape, regarded as the most important driver, followed by growth opportunities, highlighting the improving economic sentiment among executives.

“Economic challenges looming over both the private and public sector are boosting already rapid growth at the top of the professional gig economy,” said Chris Preston, Managing Partner of Odgers Connect. He added, “We’re seeing rising demand for more flexible, cost-effective independent professional support from all organisations as they struggle to grow in the face of economic uncertainty and squeezed public spending.”

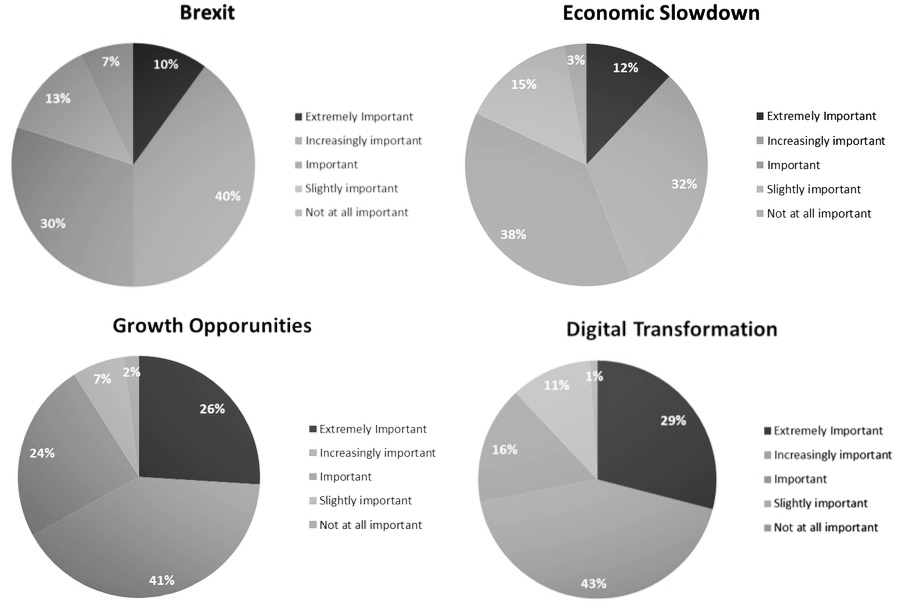

Providing objective and dedicated resourcing is cited as the key driver for hiring external support, while 16% of the consultants say that they have been tapped to add capability without raising a firm’s headcount.

Clients of independent consultants

According to Odgers Berndtson’s data, big, publicly-quoted companies account for a third of the work conducted by independent consultants. Private companies – including those with private equity backing – account for a slightly larger share of total enquiries, at 36%. The government, not-for-profit and the public sector represents a further 30%.

In their projects, the consultants surveyed – Odgers Connect focuses mainly on the top tier segment of UK’s 120,000+ strong base of freelance consultants (they represent >80% of all entities in UK’s consulting industry) – mostly engage with business leaders. Over 80% of the respondents work directly with a member of the top management team, with four out of ten reporting directly to the chief executive.

Looking ahead, the outlook for independent consultants is bright, said Preston. Almost all consultants polled (96%) expect demand from organisations to work with independents to grow. Notably organic growth and M&A (exploring new opportunities to grow) were cited by 29% of consultants as an area most likely to provide greatest scope for more work by independent consultants. Well over half (63%) gave more traditional areas of organisational change and strategic reviews continuing to be the areas of work with greatest scope to grow for independents.